Need fast cash without the hassle of bank loans or credit checks? We’ve got you covered here!

We’ve done the research for you and compiled a list of the best cash advance apps that work with PayPal for you to try. These handy tools let you borrow money and transfer funds directly to your PayPal acc with no effort.

From speedy approval processes to flexible repayment, these have everything you may need. And with the added convenience of PayPal integration, your transactions are safe and secure. Check out our top picks!

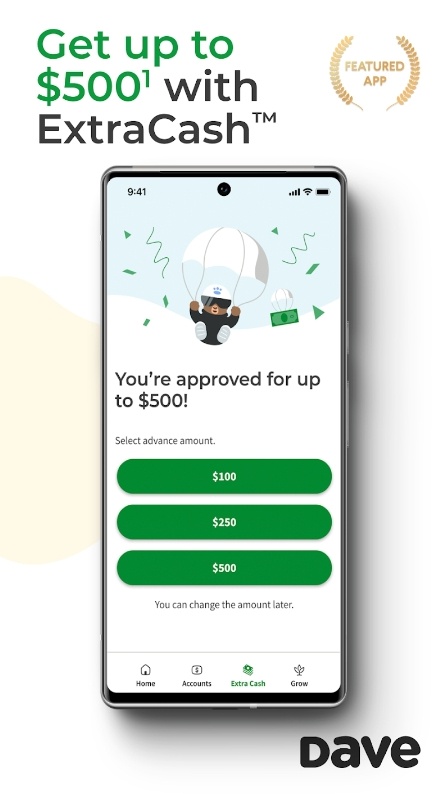

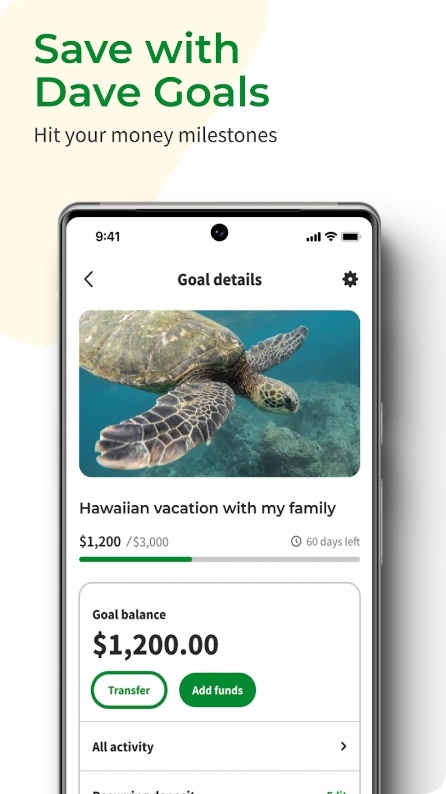

Dave

If you need a financial tool that’s both fun and helpful, this might be the one. First off, it lets you get up to $500 immediately. Impressive, right? This is a game-changer for anyone who’s ever been caught short on cash before payday.

With this little tool, you never have to miss out on fun plans or worry about making ends meet. And speaking of payday, this app can help you get paid up to two days early. That’s right, you can enjoy your hard-earned cash sooner with direct deposit into your acc.

And if you’ll ever get an app debit card, you can earn cash back from major retailers and put that money towards your savings goals. Whether you’re dreaming of a tropical vacation or trying to build up an emergency fund, this app makes it easy to save and reach your dreams.

Plus, if you need some ways to earn more money, the app can even connect you with side hustles that fit your lifestyle. Whether you’re a freelancer, a gig worker, or just need a little extra coins, there is smth that will work for you.

You may also like: 11 Best Apps Like Klover

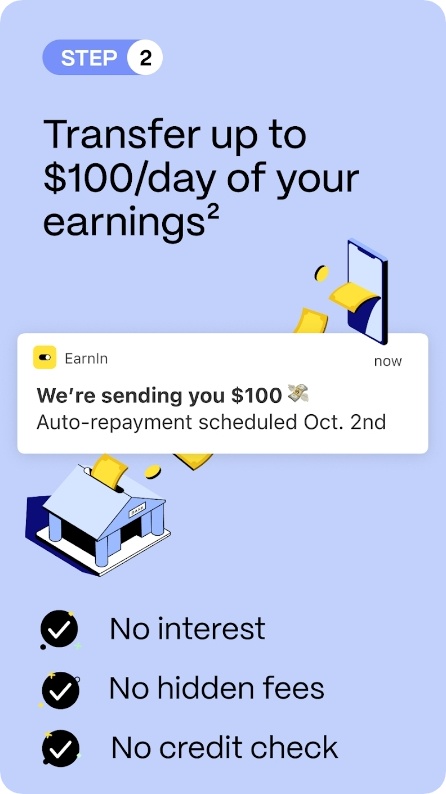

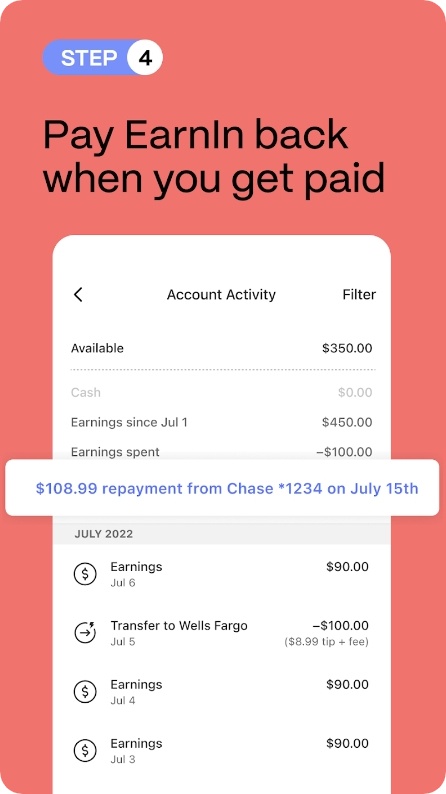

EarnIn

This app is a treat when you need to get your earnings ahead of payday. No more waiting around for what you’ve already earned: this app lets you get up to $100 a day or $750 per paycheck.

One of the things you’ll surely appreciate about this one is that it works with so many different banks. This means that no matter where you’re banking, you can take advantage of the app’s fast transfers and get your cash in mins.

Saving money can be a real challenge, particularly when you have a limited budget. But with this one, you can avoid the high IR and headaches that come with loans. Instead, you can use it to handle your cash flow and get balance shield alerts whenever your balance gets too low.

Not only that, but the app also lets you review your credit and set up alerts whenever anything suspicious happens. And if you ever have any questions or issues, the live chat team is available 24/7.

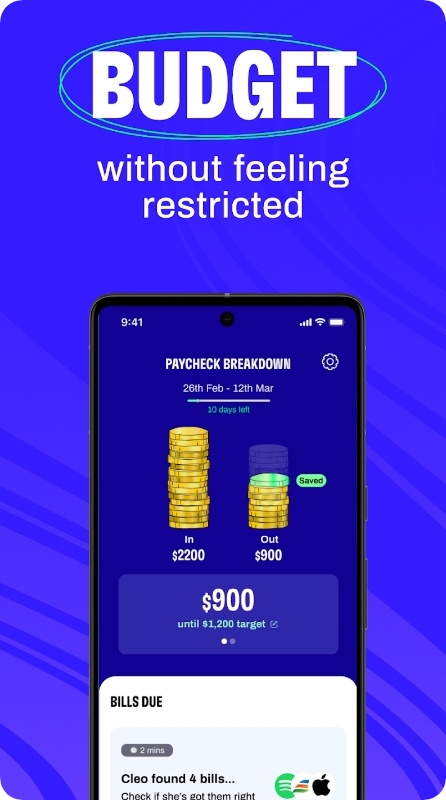

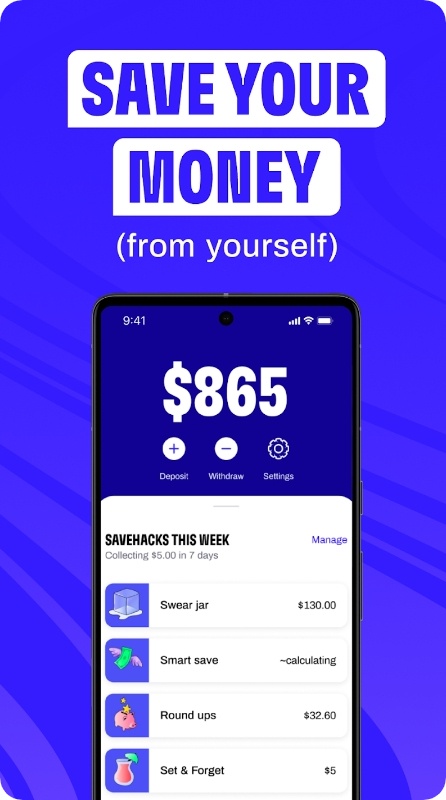

Cleo

If you wanna stop stressing out about finances, this app is for you. It will be your pocket financial buddy for cash advances and overall finance management.

What sets this one apart from other apps is its chat. You can ask any question about your funds and get real-time answers without feeling bored to death. Additionally, the app provides assistance in saving money, building credit, and even offering a cash advance of up to $250.

Why dump your overdraft when you can get a quick spot from this app? Say goodbye to those pesky overdraft fees and prepare for seamless exp.

And if you’re worried about building credit, don’t be. This app will guide your way to smoother approvals, low IR, and high credit limits Above that, you’ll get a huge cashback and a flexible budget to help keep you on track. It’s a win-win situation.

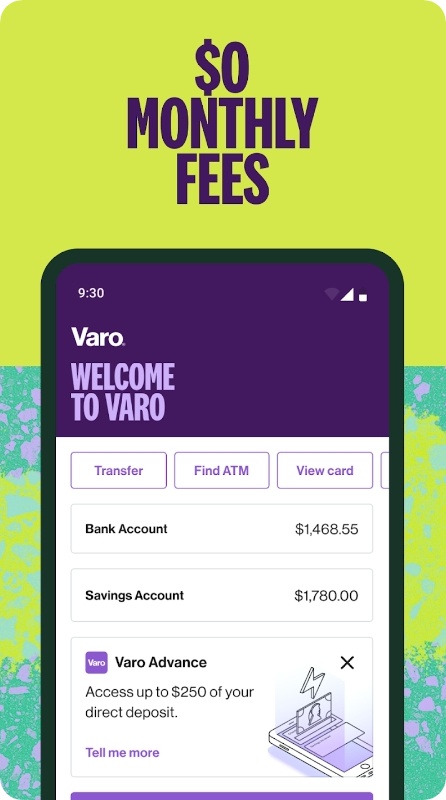

Varo Bank

It’s a simple mobile banking app to cover all your needs. It lets you borrow anywhere between $20 and $250 once you qualify. Plus, there are no fees for $20 advances, making it a stress-free way to cover unexpected bills or expenses.

Plus, you can say goodbye to fees and minimums here. This app lets you get paid up to 2 days early and the speed is lightning-fast. It’s also ideal for r contactless expenses, and you can instantly lock it in the app for added security.

And with access to over 40K fee-free ATMs at popular stores like Target and CVS, withdrawing banknotes has never been more convenient. The app also helps in finance management. You’ll get to monitor your spending with alerts and link external accs to have everything in one place.

And for those looking to build credit with everyday purchases, there’s a special credit card with no min deposit for you to get. With no (APR) and no annual fee, it’s a win-win situation for all.

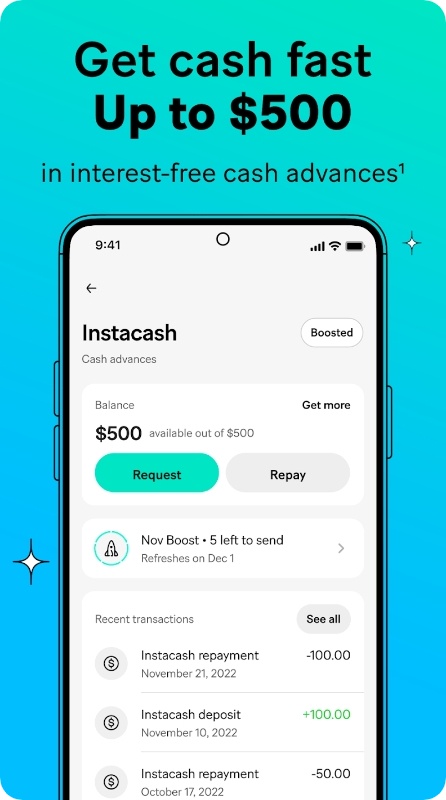

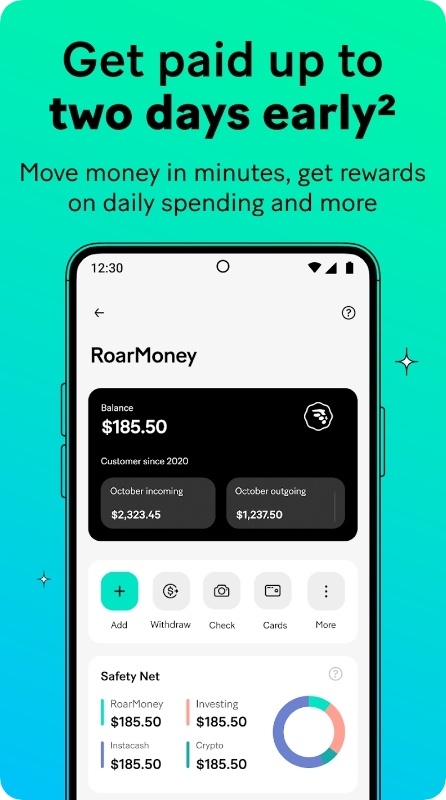

MoneyLion

If you’ve ever tried to search for a banking app, you’ve probably come across this one. It’s the app that goes above and beyond, and it has all your needs covered. With its convenient and user-friendly interface, it makes managing your finances a breeze.

And with the features it offers, you’ll be able to do a whole lot more than just manage your funds. One of the most notable tools lets you get paid up to 2 days early. And d we mention that there are no fees involved?

Plus, if you’re a fan of rewards (who isn’t?), the app lets you earn up to $500 for some purchases – that’s like a free shopping spree! The app can even help you get into investment.

If you’re in a bind and need cash fast, the app has got you covered. You can get a loan of up to $500 with no interest or credit checks! This is a lifesaver, especially when it comes to unexpected emergencies.

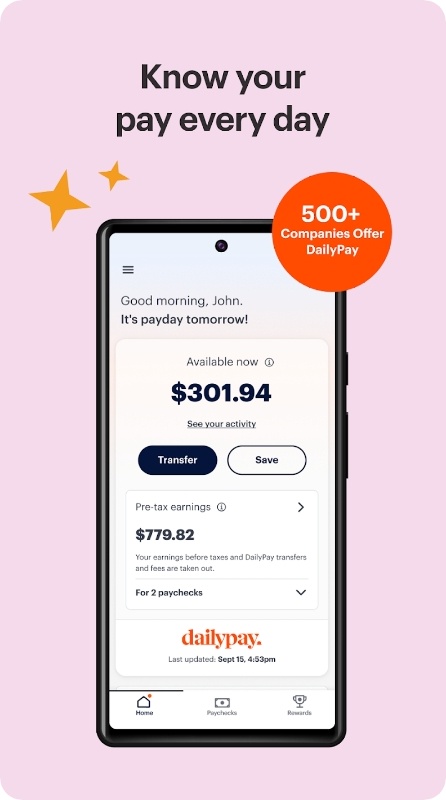

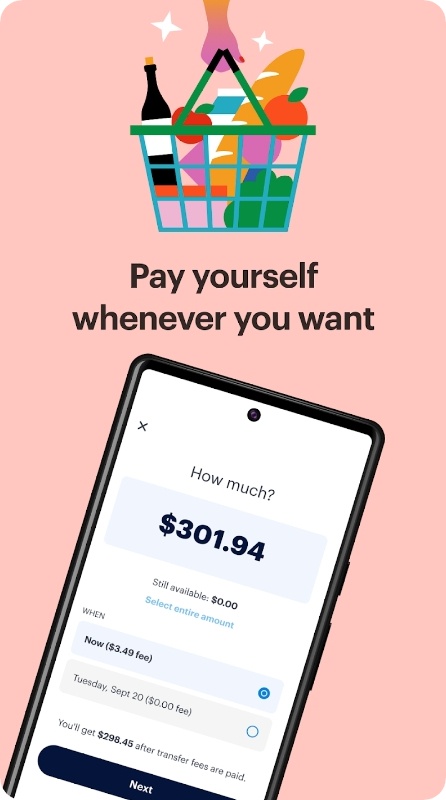

DailyPay

Here’s an app that lets you get on-demand pay without stress. Having this handy will alleviate your concerns about paying bills promptly and sidestepping late fees. It’s a treat for those wanting to gain control over their money.

Here’s how it works: every time you work throughout the week, you build up a pay balance. And with just one tap, you can withdraw from it. You can receive your funds instantly or on the next business day, depending on your prefs. And don’t worry, you’ll still receive your remaining pay on payday, just like usual.

This app makes sure your funds go where you want them to go (bank acc and card of any kind). Plus, the app gives you timely insights into your daily balance as you work, and you can opt into instant alerts if needed.

When it comes to security, the app has got you covered. They use high-level encryption, and their payment network and customer support channels are stunning.

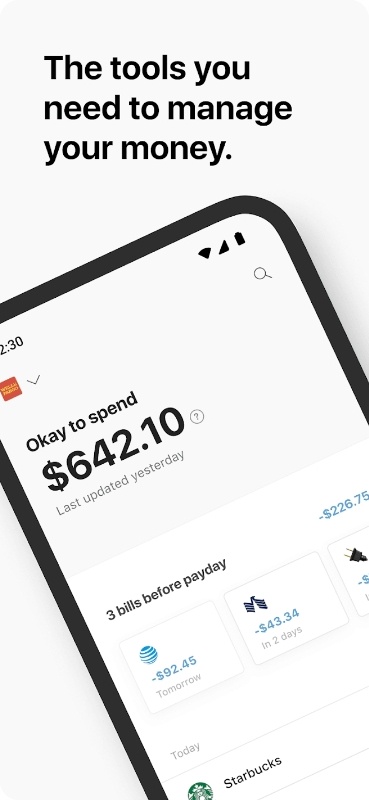

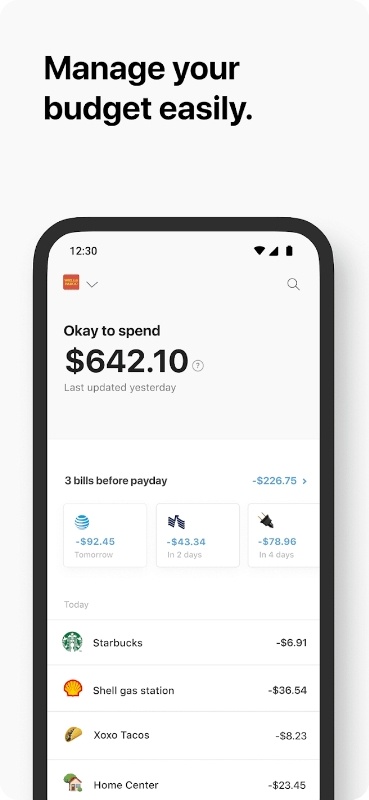

Even

It’s a versatile app that helps you deal with finances. First things first, you can get paid early. Yes, you read that right. No more waiting for payday to come around. You can request up to 50% of your next paycheck and receive the funds in secs!

And the coolest part? There are no concealed charges or IR that will make you feel deceived. And the app operates with PayPal, too. But wait, there’s more! With this one, you can start saving automatically. Decide on a percentage of your paycheck that you want to save, and it will be put straight into your savings acc.

You don’t have to lift a finger! You can adjust or transfer funds at any time, and you’ll earn interest at twice the national rate! The app is super easy to use, and the interface is sleek and intuitive.

It’s a nice app for budget administration as well. It tells you what’s ok to spend each day, based on your monthly expenses. So, you’ll never overspend or be left wondering where your funds went.

Check also: 7 Best Overdraft Apps in the USA

CashNow

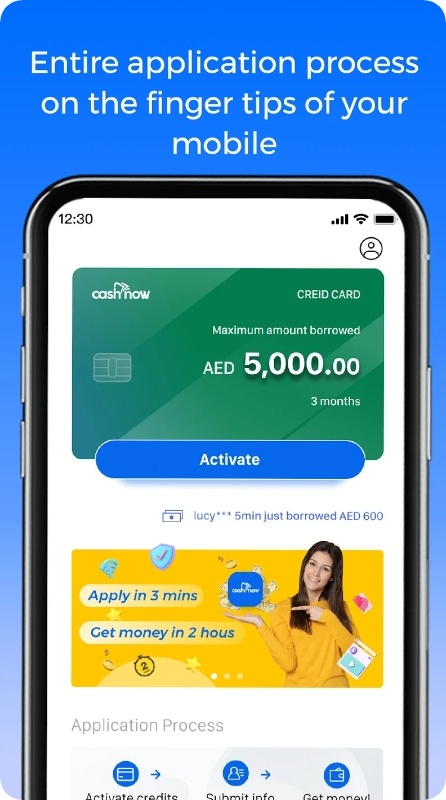

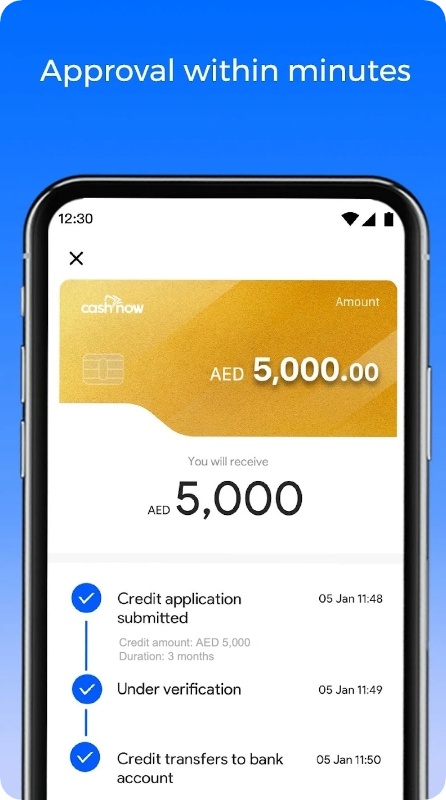

This app is a gem if you need some extra cash quickly (and want a hassle-free experience). The app covers affordable online loans that are accessible regardless of nationality and profession. Plus, it’s super easy to use!

First of all, the UI is simple and intuitive, so you can apply for a loan anytime and anywhere. You can register with your number and ID, making the application smooth and stress-free. No need to wait in long lines or fill out complicated paperwork!

The app is also very flexible and accommodating. It’s a great option for anyone who needs some financial help but struggles to find a lender that understands their unique situation. When it comes to getting your cash, the app is also on top of it. All kinds of bank accs are supported, and it works with PayPal.

The loan requirements are straightforward and easy to understand. The repayment terms are also accessible, with a time frame of 91-180 days based on your budget and financial plan.

Payactiv

This app offers a dependable way to receive payment while you actively earn, with the involvement of your employer. It lets you connect with your employer and get the wages you’ve earned from hours you’ve already worked directly into your bank acc or card.

You get up to 2 days early deposit with no effort at all. You also get immediate access to wages earned today, ensuring that you never have to wait for your hard-earned money again.

Plus, there are no IR and no concealed fees. The app even has its own Visa card with top-notch security if needed. You can also use it to receive and send funds to other members. The speed is lightning-fast, too.

It even offers spending guidance to help you start saving immediately. You can monitor the flow, know what’s safe to spend, and much more. You can even set alerts for low balances.

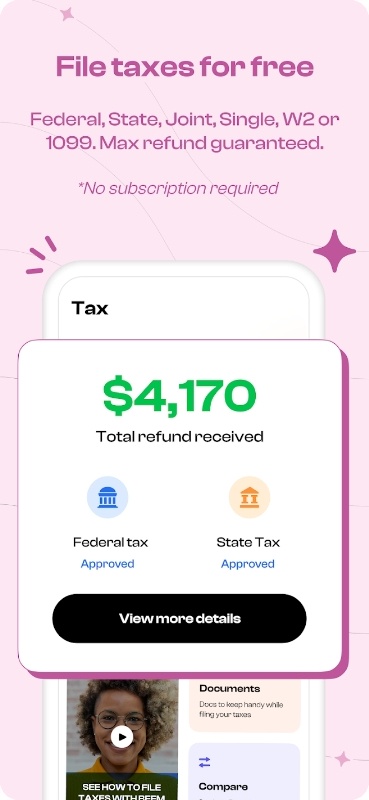

Beem

It’s a user-friendly app that gives quick cash advances. To get more precise, you can get up to $1K instantly, with no credit checks, no income restrictions, and no due dates. That’s right, whether you need a few extra dollars to make it through the week or a quick injection of cash to cover an unexpected expense, this app has you covered.

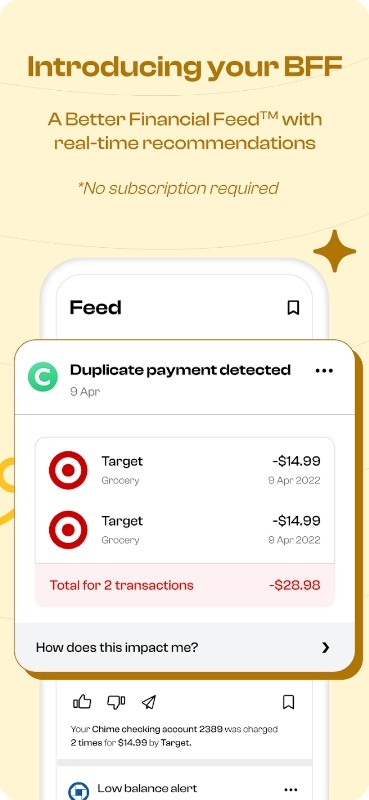

And the best part? It is more than just a cash advance tool. With its AI-powered BFF, you can manage your funds like never before. There are flexible tools to cover all your needs, from fast transactions to overdraft alerts.

The app makes it easy to send money to someone, too. The same goes for filing your taxes, it’s a real-life savior if you’re not quite sure how to do that right. And if you need even more cash, you can unlock additional funds with cash boosts and grow your credit score over time.

The app runs on sub-packs, but the costs start low, so it won’t cost you that much. There’s really nothing to lose and everything to gain.

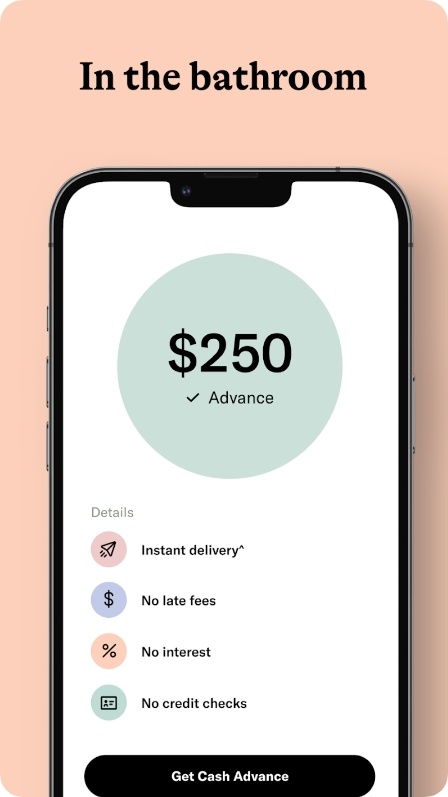

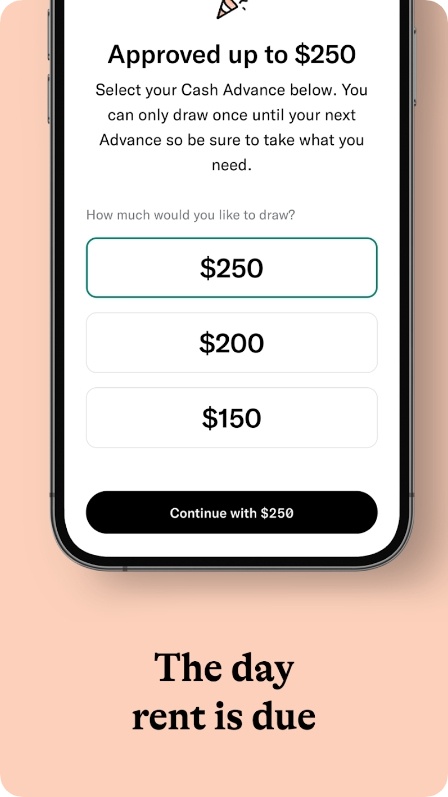

Empower

Tight on cash and need some quick bucks? This app has got you covered. It will give you up to $250, so you don’t have to ask your pals for any cover-ups. Plus, there’s no need to worry about any interest, fees, or smth. You just have to pay them back on your next payday.

One thing you’ll love about this one is that it’s not a personal loan. You don’t have any mandatory repayment timeframe, and there’s 0% APR. For instance, if you take a $50 advance with a $3 delivery fee, then your total repayment amount will be $53. Simple, isn’t it?

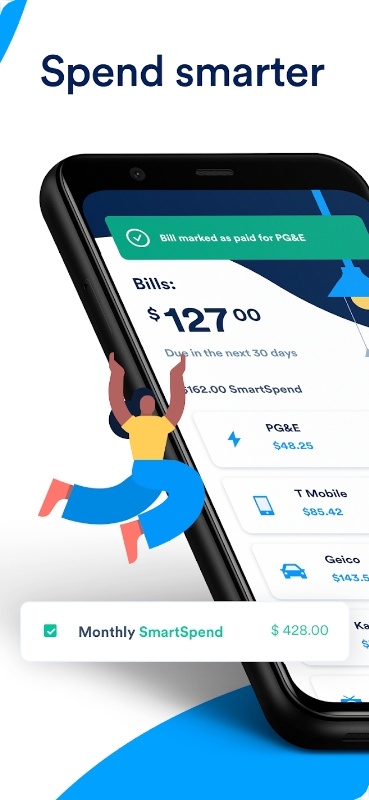

The app doesn’t end there. By setting aside your bill money, you can avoid unintentionally spending the funds needed to settle them. Take charge of your savings by determining how much to set aside and when. When the bill is due, simply withdraw the specified amount from your account. Voila! You’ll effortlessly pay your bills on time.

Plus, you’ll be able to get early paychecks). And you get up to 10% cashback and save money on everyday purchases.

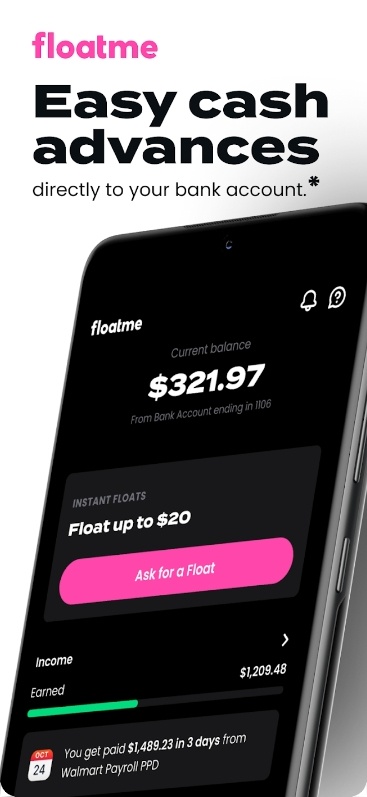

FloatMe

This app is here to elevate your financial prowess. First off, it’s so easy to get started with this one. Simply connect your bank acc and you’re ready to roll. And let us tell you, the benefits will just keep coming.

Once you’re done, you can request extra funds without any cost and receive the money within 3 days or less. And if you’re in a pinch and need the funds sooner, you can expedite it for a small fee (you’re basically paying for a pro sub pack).

But that’s not all. The low-balance alerts are amazing, too. These take the overdraft worries away instantly, and keep you in the know about your funds, too. It also operates as an edu tool. The app analyzes your behavior and offers spending insights.

The app even offers side gig opportunities! It has partnered with a variety of third-party services to give you versatile opinions. It’s never been easier to supplement your income.

You may also check: 9 Best Apps like Possible Finance

Vola Finance

To wrap up, we have an app that makes finances stress-free. It helps you avoid overdrafts and any kinds of unwanted charges. The app is quite rich in features as well. It covers overdraft protection, cash advances, funds monitoring, and all that.

What really sets this one apart is its unique algorithm that not only advances your paycheck but also helps you build up your credit score. It will grow on its own as you pay your advances back. It’s like having a personal finance coach right at your fingertips!

As for the loans, you can get up to $300 right away: it literally takes 3 taps. But let’s talk about the user experience: the app is user-friendly and easy to navigate, making managing your finances a breeze. You won’t have to worry about restrictive fees or managing multiple expenses with limited finances.